The link: http://www.fool.com/investing/general/2013/04/05/why-bitcoin-is-doomed-to-fail.aspx

The article is not written by an Austrian. But he points out a few important facts that prove bitcoin is not now, and never will be, a medium of exchange.

1. Nobody is actually buying anything with bitcoins. We are talking about hoarders almost exclusively [99%].

The bitcoin crowd will have you believe that you could open a giant mall with all the constant buying and selling going on with bitcoins. They publish catalogues, they list lists, they say bitcoin is already thriving as a currency.

But the facts are exactly the opposite. 99% of the bitcoins in the world were mined, and then held onto tightly, like Smaug the Dragon sitting on his gold.

Sorry guys, that is not a medium of exchange. At all. A medium of exchange is something you use to buy stuff, not something to sleep on.

2. Bitcoin all in all is a tiny tiny market.

A medium of exchange has to be in very wide usage. But only a small number of people have anything to do with it. Add that to the fact that 99% of those who have touched it are hoarding it, and we see that bitcoin is not a medium of exchange at all.

3. The price of a Bitcoin is directly related to the publicity given to Bitcoin.

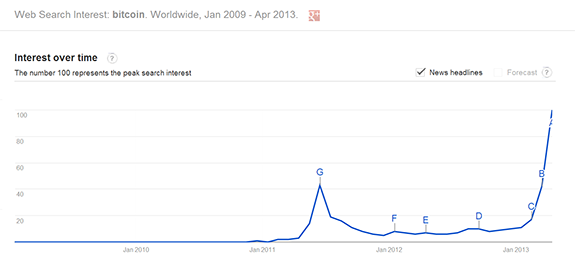

I love these two charts:

What do you call a thing that goes up and down in prices depending on publicity? A fad, that’s what. Bitcoin is a fad, and like all fads, will go out of fashion some day.

4. The moment someone actually tries to release a significant amount bitcoins on the market [for example, actually use them as money], bitcoin prices will drop like a stone.

Which is exactly what a money isn’t. Imagine if the moment you went to the store with your dollars, their value melted away? Would you accept payment in dollars, or try and find something better?

For more about bitcoin, see here: https://smilingdavesblog.wordpress.com/2012/08/03/bitcoin-all-in-one-place/

1. …not supported by empirical data… my thesis…anecdotal evidence…exponential growth…

Maybe in Bizzaro world. The referenced article gives empirical data and sources.

2. My definition is not mine, but the accepted one.

3. I haven’t seen Polleit’s. Gertschev’s has been soundly rejected and refuted in the comments section of his article at mises.org [by me as well].

4. Do you really think being an “actual economist” makes one more qualified to discuss the fraud that is bitcoin? Most “actual economists” are Keynesians of one stripe or another, or believe in other absurdities, as laid out in mises.org. You may as well have argued that an “actual alchemist” is an authority on chemistry.

5. Let’s have some anecdotal evidence here, Pete. What have you bought with your bitcoins? How many are you hoarding? What percent have you shopped with? Has there been an exponential growth in the amount of things you buy with bitcoin? What is the velocity of your bitcoins?

And I ask the same questions of anyone reading this. Let’s do some field work here.

LikeLike

1. To say bitcoin has the same velocity as a euro is odd. People spend their euros right away; they hoard their bitcoins.

2. I refer the interested reader to my article Bitcoin All In One Place.

3. Addressed in the comments to his article.

4. You think all references are created equal. OK, then, I refer you to my articles.

5. Way to avoid answering the questions.

I must say you are faithful to your pledge, Pete. Admirable.

LikeLike

You are just sad smiling dave, haha.

Your power of analysis is laughable.

LikeLike

Grudge no expense – yield to no opposition – forget fatigue – till, by the strength of prayer and sacrifice, the spirit of love shall have overcome .

Maria Weston Chapman

LikeLike

The correlation between Bitcoin price and its popularity does not prove dependence on popularity. What if it is the inverse? Fluctuations in price may prompt media coverage rather than the other way around.

LikeLike

David, thank you for your comment. That price correlates with popularity is one of the laws of supply and demand. I think you mean bitcoin price and publicity.

You are right, correlation does not prove causation, if that is the only evidence.

But it can make us think. Why do other stocks not have this correlation, as the motley fool article shows? Why do the fluctuations in price of Apple, say, not prompt corresponding media coverage?

And it makes us think again, all the thoughts in the motley fool article. Why are all other currencies reasonably stable, yet bitcoin fluctuates so precisely with its publicity?

And again. What fundamentals are there to bitcoins that determine its price? What changes make the price change?

If we then add in Mises’s regression theorem, that implies bitcoins are doomed to worthlessness like all the other phony moneys that preceded it, all the questions point in the same direction. Bitcoin is a fad. Fads thrive on buzz and media exposure.

So big picture, price of bitcoin of depending on publicity, though not proven by the correlation, is supported by it.

LikeLike

Let’s see what I wrote back then.

1. The vast majority of ALL bitcoins are hoarded. You counter this by saying that the tiny amount of NEW bitcoins are not. See the flaw?

2. Very few people use it to buy stuff, certainly not enough to make it a medium of exchange. You counter this by saying there are more users, and the market cap has tripled.

“Son, have you improved in school? Did you finally get a passing grade of 70?” “No, Dad, but my grades have tripled since a year ago. I went from one ten millionth to three ten millionths.”

You see the flaw.

3. Bit coin price is directly related to publicity. You counter this by saying it has tons of publicity now, but the price is way lower. Son, I was talking about good or neutral publicity, not the devastating soul wrenching publicity of the world’s largest bitcoin exchange ripping people off to the tune of seven hundred million dollars, then declaring bankruptcy.

4. I quoted the motley fool website as saying that if someone released a substantial amount of bitcoins, the price would plummet, unlike a substantial amount of shares of any large stock, say Bank of America. You counter by saying that if China dumped four trillion dollars on the market the same would occur. You explain that that’s how asset classes work, and welcome to free markets, which operate based on supply and demand.

I guess I should have quoted the motley fool article at greater length, to help you avoid that blunder. He points out that there is no demand for bitcoin, compared to huge volume of bitcoins out there. Contrast this with, say, pork bellies. Nobody has to store away 97% of the pork bellies in existence to make sure their price doesn’t fall to zero, because there is a huge demand for pork bellies. And China could cause huge inflation by actually spending their 4 trillions of dollars, but they will not bring about the collapse of the dollar. But if the hoarders released their bitcoins, which is what being a money is about, its price would drop to zero.

As you said so correctly, it’s all about supply and demand, and bitcoin has no demand, compared to the vast supply being hoarded. Welcome to the free market, as you so aptly said.

You conclude by claiming bitcoiun is “thriving”. I guess if losing half of its value in a few weeks is thriving, and if 6%[!!!!!!] of it getting stolen overnight, causing mass panic in the bitcoin markets, is thriving, then yes, it is thriving. But had you read my other articles on bitcoin, you would have seen that I said it would thrive until the next deep recession hits.

My claim in this article, that bitcoin is not and will never be a money, stands true. A year has passed and it is no closer to being money. Nothing is priced in bitcoin, nobody is willing to pay or to accept a salary in bitcoin.

Finally you ask why I think I was wrong. My Sherlock Holmes powers deduce from this that you are a lawyer by profession. When did you stop beating your wife?

LikeLike

FYI, David Kramer posted the above article on his facebook page here:

And thanks for helping me really understand the regression theorem Smiling Dave.

LikeLike

You’re welcome, Erik. It’s always nice to see people like my stuff.

Maybe this is a silly q, but who is David Kramer?

LikeLike

Greg,

1. If it isn’t money at all why talk about how great it is to hoard money? It’s not money, and the proof of that is nobody uses it to buy stuff. They hoard it.

2. About trends. If a tortoise starts going at two inches per hour from one inch per hour, that does not prove the tortoise is a rocket ship. Both the amount of bitcoins and the amount of things bought with them are tiny tiny tiny, trend or no trend.

3.We are talking about connection of bitcoin to publicity. That makes it relevant.

4. I don’t see anything here related to what I wrote.

Let’s not dignify bitcoin by describing it as an asset class. It’s not an asset, and not a class, and not an asset class. It’s the Emperor’s New Clothes, which were high priced until they weren’t.

LikeLike

David Kramer used to post on the Lew Rockwell blog:

https://www.lewrockwell.com/author/david-kramer/?post_type=lrc-blog

He doesn’t anymore because he wanted to be a little too provocative/inflammatory for Lew’s tastes, so he voluntarily left and now posts whatever he wants on Facebook.

LikeLike

One step closer to the big time, hey? Thanks for telling me, Erik.

LikeLike

Greg, to have a fruitful discussion we must know what we agree about, and take it from there to discuss what we disagree about. I say this because you seem to think I am against saving, or against saving bitcoins. And that I don’t know one can buy things here and there with bitcoins.

I have written over a dozen articles about bitcoin, starting from first principles. The motley fool one you and me are commenting about right here is one that assumes prior knowledge of things I wrote elsewhere. All the points you raise have been discussed in other articles. So I humbly refer you to my articles “Bitcoin Takes a Beating” and “Bitcoin All in One Place”, where the preliminary spadework is.

Could you please quote for me where I predicted those three things?

LikeLike

Lol…good one. You’re welcome.

LikeLike